It is no longer news that Nigeria is currently in an economic dilemma. So much has been written and discussed, yet, the person on the street still wonders what the problems, and more importantly, the solutions are. This post provides a simplified summary of the economic issues affecting Nigeria, and offers some near and long term solutions to improve the state of the economy.

- Nigeria is an exporter of crude oil and produced an average of 2.1 million barrels per day in 2015.

- Nigeria’s oil (Bonny Light for example) sold for about $98/barrel (January 2014), $48/barrel (January 2015) and $33/barrel (January 2016).

- In January 2014, Nigeria had an earning potential of $205.8m per day from selling 2.1mbpd of crude at $98/barrel. That potential, by estimate, dropped to $100.8m per day in January 2015, and $69.3m per day in January 2016(2.1mbpd, $33/barrel).

- Nigeria exports a number of things (crude oil being the main item) but is also significantly dependent on imports for industrial use and local consumption.

- Local businesses that require foreign exchange (dollars) to buy imported equipment, building materials, automobiles, fabrics and food products are currently in trouble. Why? Foreign exchange is not readily available to them, and where available, it is sold at a premium, as high as N390 to a dollar recently.

- Nigeria’s current monthly dollar demand is said to be approximately 3.5bn if media reports are to be believed. Compare that with an estimated monthly oil export earning of ~$2bn (2.1mbpd, 30 days, $33/barrel). Demand obviously exceeds supply and the rate on the dollar goes all the way up.

- In 2 years, Nigeria has lost ~65% (about $25bn average annual loss) of its foreign exchange revenue potential due to falling crude prices. In other words, the amount of dollars available to run the economy has dropped significantly. Recall that crude oil sale accounts for about 95% of our foreign exchange earnings.

- In the 3rd quarter of 2015, PMS accounted for 44% of our imports, the highest single import item. Similarly, PMS was 39% and 35% of imports in 1Q and 2Q 2015 respectively. Obviously, petroleum products dominate our import bill.

- What have we spent the bulk of our foreign exchange revenue on? PMS imports! What is draining our earned dollars? PMS imports!

- One of CBN’s initial responses involved drawing down on our foreign reserves to sustain the import bill. This resulted in a steady decline of foreign reserves — currently down to about $27.8bn. Consequently, other measures were put in place to manage demand for the dollar.

- One of these was the exclusion of importers of 38 goods from accessing dollars from the Nigerian foreign exchange market. The goods (rice, cement, poultry, etc.) were however not banned from being imported!

- The sale of (our few available) dollars is now targeted at local producers at the official rate, N199.5: $1, to stimulate local production (Buy Naija, Grow the Naira). All others who need dollars are left with no option than to buy from the parallel market at whatever rate meets the day.

- CBN also halted the regular sale of foreign exchange to the parallel market (Bureau de Change), leaving ‘black market’ vendors to source the dollar by alternative means. The result? Further scarcity, leading to exchange rates as high as N400 to a dollar.

- This has created an unhealthy spread between the official and parallel market: N199.5 versus N390+ to a dollar. If a Nigerian business man gets $4,000 at the official rate, is there not sufficient incentive to simply sell off at the parallel market and make an instant gain of at least N760,000 without engaging in any value-adding activity?

Obviously, Nigeria needs to increase foreign exchange revenue to be able to sustain her economy and reverse these early signs of a declining trade surplus. How can we grow forex earnings though?

Diversify our export base and focus on other locally produced, non-oil items.

Focus on agro-products like cocoa where Nigeria already has some leverage. The International Cocoa Organization estimated that Africa will lead global cocoa exports in 2015, with Nigeria being 4th largest producer in Africa, 9th in the World (2015 estimates). More so, in April 2012, at the Conservation Alliance, agriculture experts predicted Nigeria will be the largest global producer of cocoa within 10 years. Wishful thinking? Or worth government policy focus backed by private sector funding? According to the NBS’ Foreign Trade Statistics Report, apart from oil and gas, cocoa was Nigeria’s highest foreign exchange earner in Q3 2015. Some State Governors (Abia, Adamawa, Akwa Ibom, Cross River, Delta, Edo, Ekiti, Kogi, Kwara, Ogun, Ondo, Osun, Oyo and Taraba) need to evolve action plans to achieve quick wins here and spend less time engaging in boisterous political tirades in the media.

Other items that earned Nigeria significant foreign exchange in Q3 2015 are rubber, cigarettes, aluminum alloys and leather.

According to the Rubber Research Institute of Nigeria, rubber is produced in Abia, Akwa Ibom, Anambra, Bayelsa, Cross River, Delta, Edo. Rivers, Ondo, Ogun, Taraba, Oyo, Ebonyi, Enugu, Osun, Ekiti, and Kaduna. What are these States doing to increase capacity?

Growing capacity in these areas will not only diversify our export base in the medium term, it will also increase employment in the agriculture and manufacturing sectors. Government policies must lean in this direction, to attract and encourage private sector funding. States Governors should evolve action plans to achieve quick wins and spend less time engaging in boisterous political tirades in the media.

The other significant option is glaring. Develop an action to stop importing PMS. What have we spent the bulk of our foreign exchange revenue on? PMS imports. Grow in-country capacity to refine crude into petroleum products and watch the dollar burden on imports drop significantly.

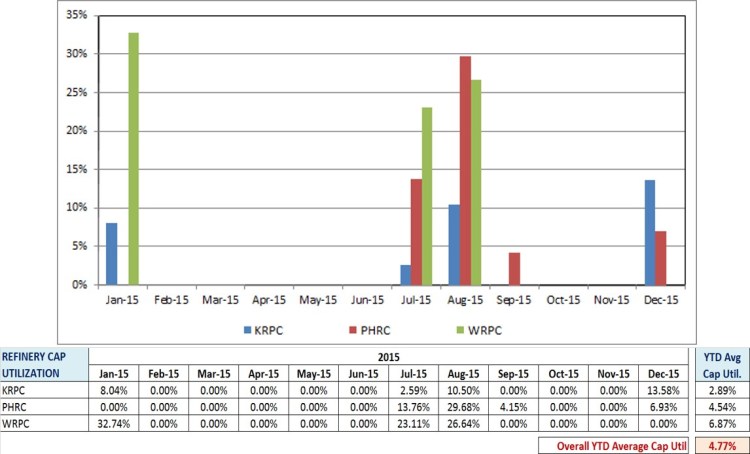

Our 4 refineries have continued to perform subpar in spite of repeated turnaround efforts. Capacity utilization in 2015 was dismal.

These refineries need to be commercialized and then privatized to restore business efficiency. While this is in process, an emergency cause needs to be invoked to fast-track the construction new refineries to support local demand for PMS (realistically about 25 million liters per day, excluding border smuggling) and export to neighboring countries. Licenses were granted in 2015 for the construction of 65 modular refineries. What is the progress status on these? Dead on arrival? The current management of the NNPC has done an admirable job in promoting and actualizing PMS price modulation in spite of the President’s leanings. This already encourages private refineries to build, produce and sell profitably. Oh but guess what? They will require substantial forex to support fast-tracked construction. The refinery modules will be imported!

These options will however require time to actualize and may not be any immediate benefits. What is most critical is the assurance that our leaders are crystal clear on the issues and publicly committed (in word and deed) on a dogged resolution plan…. Grow Nigeria, Save Nigeria!

Discussion

No comments yet.